27 Feb It’s Tax Season: What You Should Know About Form 1095-B

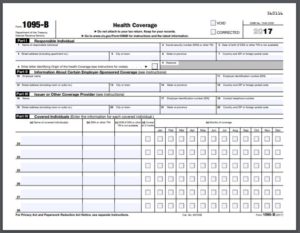

Taxpaying individuals and their dependents who are covered by minimum essential coverage will need Form 1095-B to report details to the IRS. According to HealthCare.gov, “Any insurance plan that meets the Affordable Care Act requirement for having health coverage. To avoid the penalty for not having insurance you must be enrolled in a plan that qualifies as minimum essential coverage (sometimes called “qualifying health coverage”). Examples of plans that qualify include: Marketplace plans; job-based plans; Medicare; and Medicaid & CHIP.” Ultimately, the form verifies health care coverage needed to ensure a tax penalty is not incurred.

Taxpaying individuals and their dependents who are covered by minimum essential coverage will need Form 1095-B to report details to the IRS. According to HealthCare.gov, “Any insurance plan that meets the Affordable Care Act requirement for having health coverage. To avoid the penalty for not having insurance you must be enrolled in a plan that qualifies as minimum essential coverage (sometimes called “qualifying health coverage”). Examples of plans that qualify include: Marketplace plans; job-based plans; Medicare; and Medicaid & CHIP.” Ultimately, the form verifies health care coverage needed to ensure a tax penalty is not incurred.

If you’re not sure whether or not you need to use Form 1095-B, ask yourself these questions:

- Did I, my spouse, and/or dependents, have health coverage for all of 2017?

If yes… You will receive Form 1095-B from your employer or insurance provider. This form will report details including name, address, and social security number of the individuals and independents who had health coverage. I will also provide details about when they were covered. Employers will file a 1094 cover sheet and include a set for all covered employees with the IRS. Full instructions for this form are on on the IRS website.

- Was I employed by an Applicable Large Employer (ALE) with at least 50 full time employees?

If yes… You will need to file Form 1095-C instead of Form 1095-B. Though similar forms, in that they identify information about those covered and when they were covered, the employer type/requirement is different. Full instructions for this form are on on the IRS website.

If you had multiple providers or if your coverage or employer changed last year, you may receive more than one form. Again, depending on your employment and health coverage in 2017, you may even receive one (or more) of each form. When you file taxes, you will need to specify if you had health coverage or not. It’s good to know that these are reference forms that intended to help with the preparation of taxes for filing, however, they do not need to be sent to the IRS. In most cases, it is just fine to proceed to file your tax return before you have received the 1095 form(s), just make sure to file them away.

Deadlines:

Take note that the deadlines for employers to provide Form 1095-B to employees was extended to March 2, 2018. The deadline for filing Form 1095-B and 1095-C with the IRS has not changed. Per the IRS “The due date is February 28, 2018; if filing electronically, the due date is April 2, 2018.” Taxes are due Tuesday, April 17, 2018 so now is the time to start collecting everything you need and start asking questions if you don’t know how to handle any of the forms required.

No Comments